Hey there, friends! Let’s dive straight into something that’s been on everyone’s mind lately: the PPP loan forgiveness list. If you’re reading this, chances are you’ve either applied for a PPP loan or are considering it. But here’s the thing: navigating the world of forgiveness can feel like trying to solve a Rubik’s Cube blindfolded. Don’t worry, though; we’ve got your back. This guide will break it all down for you in a way that’s easy to digest, so you can focus on what matters most—your business.

You see, the PPP loan program was created to help small businesses survive during tough economic times. It’s not just about getting the money; it’s about making sure you can get that loan forgiven. That’s where the PPP loan forgiveness list comes in. Think of it as your golden ticket to financial freedom. But hey, before we dive deeper, let’s make sure we’re all on the same page. Stick with me, and I’ll walk you through everything you need to know.

Now, let’s be real: the process of forgiveness isn’t exactly a walk in the park. There are forms to fill out, documents to gather, and deadlines to meet. But don’t let that scare you off. By the end of this article, you’ll have a clear understanding of how the PPP loan forgiveness list works, what you need to do to qualify, and how to maximize your chances of getting that loan forgiven. Ready? Let’s go!

- How Much Simon Cowell Is Worth Unveiling The Net Worth Of A Music Mogul

- Room 227 Cast The Untold Stories Behind The Laughter And Talent

What Exactly is the PPP Loan Forgiveness List?

Alright, let’s start with the basics. The PPP (Paycheck Protection Program) loan forgiveness list is essentially a compilation of businesses and organizations that have successfully had their PPP loans forgiven. It’s like a VIP list, but instead of getting into a fancy club, you’re getting financial relief. Sounds pretty sweet, right?

Here’s the deal: when you apply for PPP loan forgiveness, your lender reviews your application and submits it to the SBA (Small Business Administration). Once approved, your loan is forgiven, and your name might just end up on that list. But here’s the kicker: not everyone makes it onto the list. It all depends on how well you meet the requirements and document your expenses.

Now, why does this list matter? For one, it provides transparency. It shows which businesses are benefiting from the program and how the funds are being used. Plus, it gives other businesses a benchmark to compare themselves against. If you’re thinking about applying for forgiveness, this list can give you a sense of what to expect and how to prepare.

- Tony Gary The Untold Story Of A Legend In The Making

- Taylor Swifts Third Album A Deep Dive Into Speak Now And Its Legacy

How Does PPP Loan Forgiveness Work?

Let’s break it down step by step. First things first: to qualify for PPP loan forgiveness, you need to spend the funds on eligible expenses. These include payroll costs, rent, utilities, and mortgage interest. The key here is to ensure that at least 60% of the loan is spent on payroll expenses. If you don’t meet this threshold, your forgiveness amount could be reduced.

Another important factor is the covered period. This is the timeframe during which you must use the funds to qualify for forgiveness. Typically, it’s either 8 or 24 weeks after receiving the loan. During this period, you’ll need to keep detailed records of all your expenses. Trust me, this is where good bookkeeping becomes your best friend.

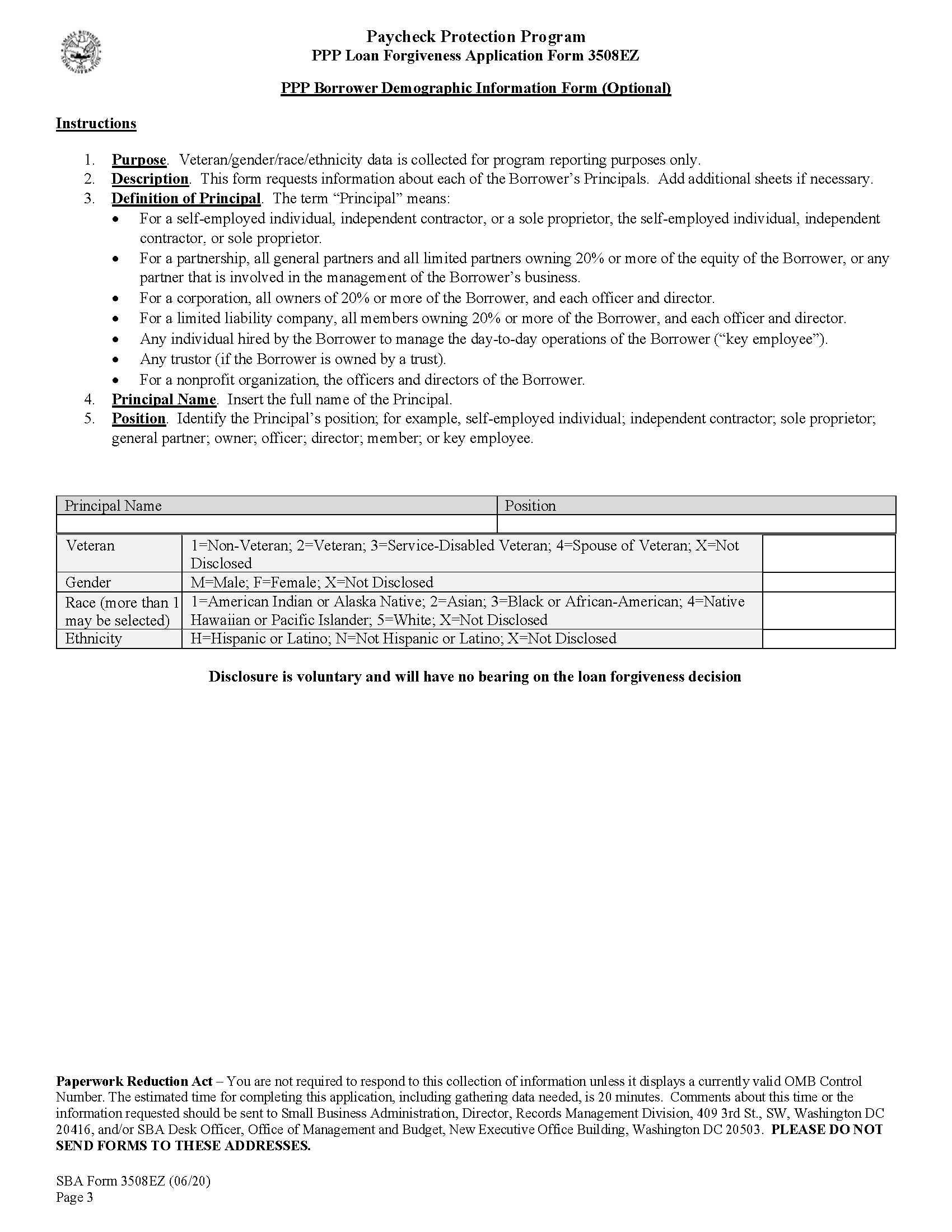

Once you’ve spent the funds, it’s time to apply for forgiveness. You’ll need to complete Form 3508, 3508EZ, or 3508S, depending on your situation. Along with the form, you’ll need to submit supporting documentation, such as payroll reports, lease agreements, and utility bills. It might sound like a lot, but trust me, it’s worth the effort.

Eligible Expenses for PPP Loan Forgiveness

Let’s talk about the nitty-gritty details of eligible expenses. As I mentioned earlier, at least 60% of your PPP loan must be spent on payroll costs. This includes salaries, wages, tips, and health insurance premiums. But that’s not all. Here’s a quick rundown of other eligible expenses:

- Rent or lease payments

- Mortgage interest payments

- Utilities, such as gas, electricity, and water

- Software subscriptions and cloud services

Keep in mind that these expenses must be incurred during the covered period. If you spend the funds on anything outside of these categories, it won’t count toward forgiveness. So, it’s crucial to stay organized and keep detailed records.

Steps to Apply for PPP Loan Forgiveness

Now that you know what qualifies, let’s talk about the application process. First, gather all your necessary documents. This includes your loan agreement, payroll records, and receipts for eligible expenses. Once you have everything in order, it’s time to fill out the forgiveness application form.

Here’s a pro tip: double-check your calculations before submitting the form. Mistakes can delay the process or even result in denial. If you’re unsure about anything, don’t hesitate to reach out to your lender or a financial advisor. They’re there to help you navigate the process.

After submitting your application, your lender will review it and forward it to the SBA for final approval. This process can take anywhere from a few weeks to a few months, so patience is key. But once you get that approval, you’ll officially be on the PPP loan forgiveness list. Congrats!

Tips for Maximizing PPP Loan Forgiveness

Want to make sure you get the most out of your PPP loan forgiveness? Here are a few tips:

- Focus on payroll expenses: Remember, at least 60% of your loan must be spent on payroll costs. Prioritize these expenses to increase your chances of full forgiveness.

- Keep detailed records: Document every single expense related to your PPP loan. This will make the application process smoother and reduce the risk of errors.

- Consult with a professional: If you’re unsure about anything, don’t hesitate to seek advice from a financial expert. They can help you navigate the process and ensure you’re on the right track.

Common Mistakes to Avoid When Applying for Forgiveness

Alright, let’s talk about some common pitfalls to avoid. One of the biggest mistakes businesses make is not spending enough on payroll expenses. Remember, at least 60% of your loan must go toward payroll costs. If you fall short of this threshold, your forgiveness amount will be reduced.

Another common mistake is failing to keep detailed records. Without proper documentation, it’s almost impossible to prove that your expenses qualify for forgiveness. So, make sure you’re keeping track of everything—from payroll reports to utility bills.

Finally, don’t rush the application process. Take the time to double-check your calculations and ensure all your documents are in order. Rushing can lead to errors, which could delay or even deny your application.

Understanding the PPP Loan Forgiveness List

Now, let’s dive deeper into the PPP loan forgiveness list. As I mentioned earlier, this list includes businesses and organizations that have successfully had their loans forgiven. But what exactly does it mean to be on this list? For starters, it shows that you’ve met all the requirements and documented your expenses correctly.

Being on the list also provides a sense of credibility. It shows that you’ve followed the rules and regulations set forth by the SBA. Plus, it gives other businesses a benchmark to compare themselves against. If you’re considering applying for forgiveness, checking out the list can give you a better understanding of what to expect.

PPP Loan Forgiveness Statistics

Let’s take a look at some numbers. As of the latest data, over 11 million PPP loans have been approved, totaling more than $800 billion in funding. Out of those, millions of businesses have successfully had their loans forgiven. But here’s the thing: not everyone makes it onto the forgiveness list. In fact, some estimates suggest that up to 20% of applications are denied due to errors or incomplete documentation.

So, what does this mean for you? It means that paying attention to detail is crucial. Make sure you’re following all the rules and guidelines set forth by the SBA. And if you’re unsure about anything, don’t hesitate to seek advice from a professional. The last thing you want is to have your application denied because of a simple mistake.

Real-Life Examples of PPP Loan Forgiveness Success

To give you a better idea of what success looks like, let’s take a look at a few real-life examples. One small business owner in California used her PPP loan to keep her employees on payroll during the pandemic. By documenting every expense and ensuring at least 60% of the funds went toward payroll costs, she successfully had her loan forgiven.

Another example comes from a restaurant owner in Texas. He used his PPP loan to cover rent and utility expenses while also maintaining his payroll. By keeping detailed records and following the SBA’s guidelines, he was able to secure full forgiveness for his loan.

Final Thoughts on PPP Loan Forgiveness

Well, there you have it—the ultimate guide to PPP loan forgiveness. By now, you should have a clear understanding of how the process works, what you need to do to qualify, and how to maximize your chances of success. Remember, the key is to stay organized, document everything, and follow the rules set forth by the SBA.

If you’re still feeling unsure about anything, don’t hesitate to reach out to a financial advisor or your lender. They’re there to help you navigate the process and ensure you’re on the right track. And if you’ve already applied for forgiveness, congrats! You’re one step closer to financial freedom.

Before I go, I want to leave you with one final thought: the PPP loan forgiveness list isn’t just about getting your loan forgiven. It’s about showing the world that you’ve done everything right and followed the rules. So, take pride in your journey and keep pushing forward. You’ve got this!

Call to Action

Now that you’ve made it to the end, I want to hear from you! Did this guide help clarify things for you? Are you planning to apply for PPP loan forgiveness? Let me know in the comments below. And if you found this article helpful, don’t forget to share it with your friends and colleagues. Together, we can help each other navigate the world of small business financing.

Table of Contents

- What Exactly is the PPP Loan Forgiveness List?

- How Does PPP Loan Forgiveness Work?

- Eligible Expenses for PPP Loan Forgiveness

- Steps to Apply for PPP Loan Forgiveness

- Tips for Maximizing PPP Loan Forgiveness

- Common Mistakes to Avoid When Applying for Forgiveness

- Understanding the PPP Loan Forgiveness List

- PPP Loan Forgiveness Statistics

- Real-Life Examples of PPP Loan Forgiveness Success

- Final Thoughts on PPP Loan Forgiveness

- Melissa Oneil Relationships A Deep Dive Into Her Love Life And Personal Journey

- Christian Bale Batman The Dark Knights Legacy And Beyond